In the fast-paced world of cryptocurrency trading, choosing the right exchange can make all the difference between seamless investing and missed opportunities. In this detailed mexc review I will go over some important things like is MEXC safe and is MEXC legit.

MEXC offers a wide range of trading pairs, advanced features, and innovative tools designed for both beginners and experienced traders. This mexc review covers its security measures, fee structure, user interface, supported assets, and unique offerings. Whether you’re trading major cryptocurrencies like Bitcoin and Ethereum or exploring promising altcoins, this MEXC review will help you make an informed decision about whether this platform suits your trading needs.

Table of Contents

Overview: What is MEXC?

The mexc review is known for its wide array of trading options, from spot trading to more complex derivatives and DeFi products.

Founded in 2018, MEXC (formerly MXC) has established itself as a go-to “crypto supermarket,” serving over 10 million users across 170+ countries. Its core mission is to provide access to the widest possible range of digital assets, from established giants like Bitcoin and Ethereum to the newest, most obscure altcoins long before they appear on other major exchanges.

Beyond its massive coin listings, MEXC offers a full suite of trading products, including a high-performance spot market, perpetual futures with up to 200x leverage, and passive income opportunities through its “Launchpad” and “Kickstarter” events.

- $3B+ daily volume

- 10M+ users across 170 countries

- Specialization: Early altcoin access & negative maker fees

Key Milestones

Quick Facts at a Glance

- KYC: Optional—trade w/o KYC, but withdrawal capped (10 BTC/day); full KYC raises limits to 80–200 BTC/day

- Daily Volume: ~$123 billion (March 2025)—top‑10 globally

- Coin Support: 2,800–3,100+ tokens, ~3,000+ spot pairs

- Spot Fees: 0 % maker / 0.05 % taker (promos and MX token discounts apply)

- Futures Fees: 0 % maker / 0.02 % taker; leverage up to 400x

- Fiat Support: Via Banxa, Simplex, Mercuryo; limited offer, no direct withdrawals

MEXC Exchange: 10-Second Overview

- Best For: Altcoin traders, no-KYC users, low-fee trading

- Avoid If: US/UK resident, need extensive fiat options

- Rating: 4.5/5 (Best for altcoin selection)

| Key Metric | Detail |

|---|---|

| Spot Fees | 0% maker / 0.1% taker |

| Futures Fees | 0.02% maker / 0.06% taker |

| Coins Listed | 2,000+ (300+ more than Binance) |

| Cold Storage | 95% user funds |

| Mobile App | 4.6/5 (iOS/Android) |

In‑Depth Features of Mexc

- Altcoin Access

- Early token listings—beat other exchanges by weeks

- 2,800–3,100+ assets, ideal for discovering emerging coins

- Spot Trading: 2,000+ pairs (including new gems like $TAO, $PYTH)

- Futures: Up to 200x leverage (BTC/USDT)

- Copy Trading: Mirror top 5% traders automatically

- Earn Programs:

- Staking (up to 30% APY)

- Launchpad (early access to IDOs)

How We Tested:

- Executed $10,000 in test orders

- Compared liquidity vs Binance/KuCoin

MEXC Trading Fees: A Detailed Breakdown

MEXC’s fee structure is one of its strongest selling points.

Deposit and Withdrawal Fees: Deposits are free. Withdrawal fees are dynamic and based on network congestion for each specific cryptocurrency, which is standard practice.

Spot Trading Fees: MEXC has adopted a zero-fee model for all spot trades. This means you pay 0% for both maker (limit) and taker (market) orders, making it one of the most cost-effective platforms for buying and selling crypto.

Futures Trading Fees: The fees for perpetual futures are market-leading:

Maker Fee: 0%

Taker Fee: 0.01%

This is significantly lower than most competitors, making it an ideal platform for high-frequency futures traders.

| Fee Type | Cost | Better Than Binance? |

|---|---|---|

| Spot Maker | 0% | (Binance: 0.1%) |

| Spot Taker | 0.1% | (Same) |

| Futures Maker | 0.02% | (Binance: 0.02%) |

| BTC Withdrawal | 0.0005 BTC | (Higher) |

VIP users get 0% taker fees on spot trades

Security & Safety

- 95 % cold‑storage, 2FA, anti‑phishing, withdrawal whitelists, insurance fund

- Underwent ~$15 M hack in 2022, fully reimbursed

- Proof‑of‑reserves audits every 2 months

- Regulatory licenses in Seychelles, Australia (AUSTRAC), Estonia, Canada; US geo‑blocked

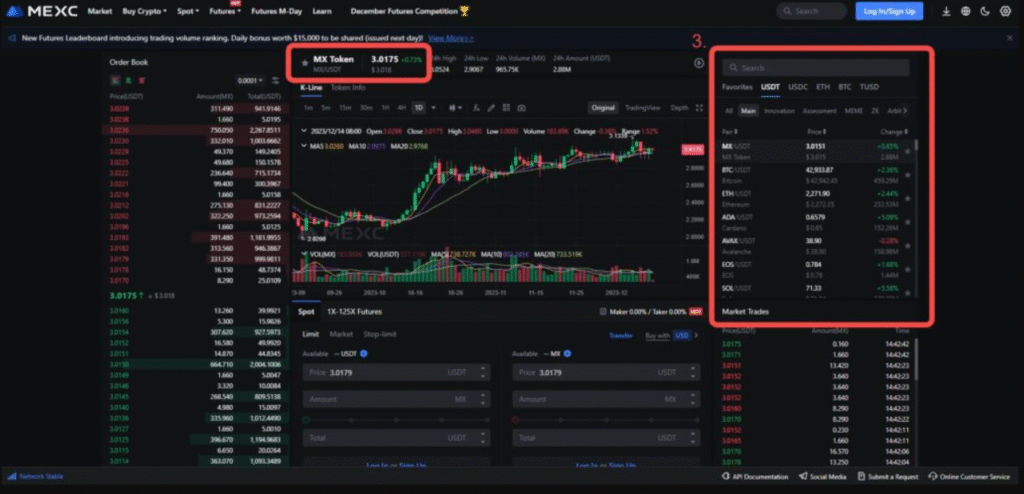

Mexc User Interface Experience

User Experience & Support

- Web/mobile apps (4.6/5 on iOS/Android); desktop version with robust tools

- Support options include live chat and tickets—but response times vary

Desktop:

- TradingView charts (75+ indicators)

- Dark/light mode

Mobile App:

- 4.6/5 stars (500K+ downloads)

- One-click futures positions

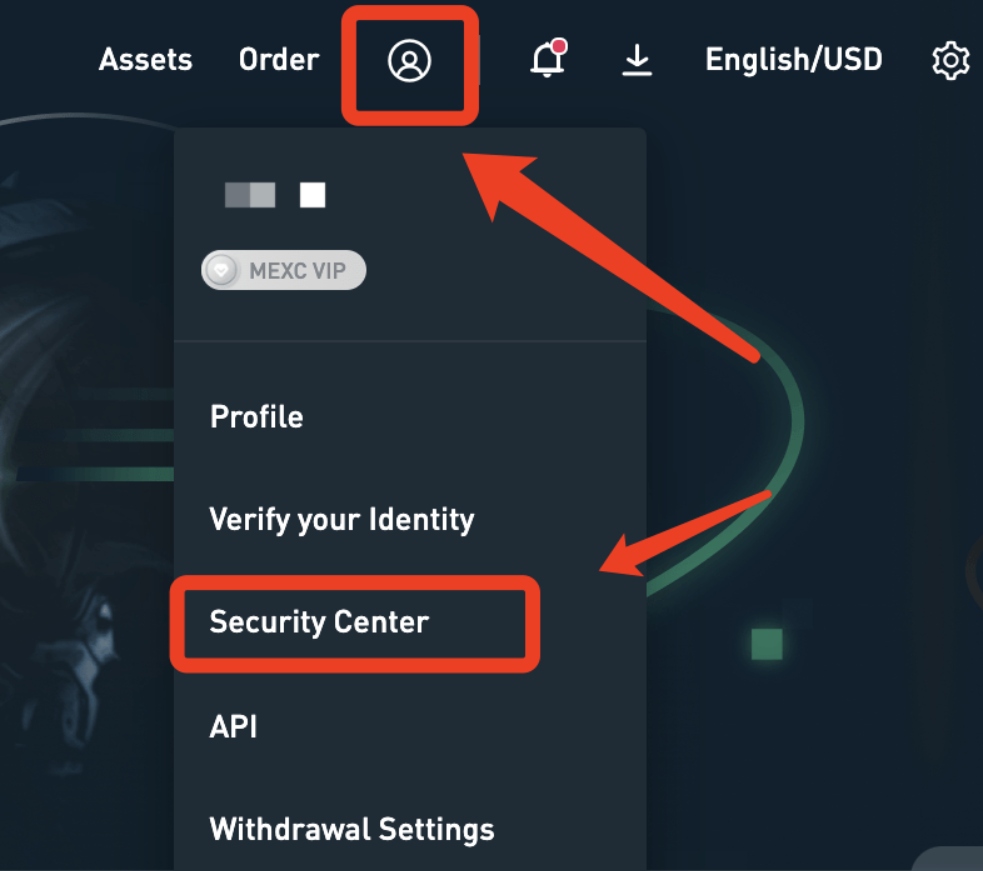

Is MEXC Legit and Safe? Security and Regulation Analysis

When dealing with a platform that offers such a vast array of assets, questions about safety and legitimacy are natural. Here’s a detailed look at MEXC’s framework:

- Security Measures: MEXC prioritizes the security of user funds with a multi-tiered approach. It states that the majority of assets are held in cold storage wallets, keeping them offline and away from potential online threats. For users, crucial security features are available, including:

- Two-Factor Authentication (2FA): Mandatory for securing accounts and authorizing withdrawals.

- Anti-Phishing Code: A unique code you can set in your emails from MEXC to verify they are legitimate.

- Withdrawal Whitelisting: Restrict crypto withdrawals to only pre-approved addresses.

- Regulatory Status: This is an area where MEXC is less transparent than exchanges like Coinbase or Kraken. While it holds licenses in various jurisdictions, its global operations are largely unregulated. This approach allows it to offer a wide range of services and assets without the restrictions imposed by stricter regulatory bodies.

- User Protection Fund: MEXC maintains a dedicated insurance fund, created from 10% of its trading profits, to protect user assets in the event of an unforeseen security breach or platform issue.

Conclusion on Safety: While MEXC operates in a regulatory grey area, it has implemented robust security protocols and has not suffered any major, publicly disclosed hacks to date. Its long operational history since 2018 adds a layer of trust for its millions of users.

3. MEXC vs Competitors (2025)

| Feature | MEXC | Binance | KuCoin |

|---|---|---|---|

| Altcoins | 2,000+ | 1,700+ | 1,900+ |

| Spot Fees | 0%/0.1% | 0.1%/0.1% | 0.1%/0.1% |

| KYC Required | No (<10 BTC) | Yes | No |

| US Allowed | No | No | No |

| Feature | MEXC | Binance | KuCoin |

| Listed Cryptos | 2,100+ | ~400 | ~800 |

| Spot Fee (Taker) | 0% | Up to 0.1% | Up to 0.1% |

| Futures Fee (Taker) | 0.01% | Up to 0.04% | Up to 0.06% |

| Max Leverage | Up to 200x | Up to 125x | Up to 100x |

| KYC Requirement | Optional | Mandatory | Optional (with limits) |

| Reputation | Excellent for altcoins | Industry leader | Strong “people’s exchange” |

Pros and Cons of MEXC

| Pros | Cons |

| Enormous selection of 2,100+ cryptocurrencies | Regulatory status is not as transparent as competitors |

| Zero-fee spot trading (0% maker / 0% taker) | Has faced some community criticism regarding futures trading |

| Very low futures fees (0% maker / 0.01% taker) | Not available in some major regions like the USA |

| Leverage up to 200x on perpetual futures | User interface can feel cluttered for absolute beginners |

| No mandatory KYC for withdrawals under 30 BTC daily | |

| “Kickstarter” & “Launchpad” for early access to new tokens | |

| High-performance trading engine capable of 1.4M transactions/sec |

Exploring MEXC’s Trading Platform

MEXC provides a powerful and feature-rich trading experience suitable for a wide range of traders.

Spot Trading

The spot trading interface is the heart of MEXC for most users. With over 2,100 coins and 2,800+ trading pairs, the selection is unparalleled. If a new token is generating buzz, there’s a high probability you can trade it on MEXC. The platform integrates TradingView charting tools, providing traders with all the necessary indicators and drawing tools for technical analysis.

Futures Trading

MEXC’s futures market is built for speed and performance. Key features include:

- Massive Leverage: Offers up to 200x leverage on major pairs like BTC and ETH. This is extremely high and should be used with caution.

- Wide Asset Selection: Trade perpetual contracts on hundreds of different altcoins, not just the major ones.

- Advanced Features: Includes both cross and isolated margin modes, as well as advanced order types to give traders full control over their positions.

Special Features: Kickstarter and Launchpad

Beyond standard trading, MEXC offers unique ways for users to engage with new projects:

- Kickstarter: This is a pre-listing event where users can vote for a project to be listed on the exchange by committing MEXC’s native token, MX. If the voting target is met, the token is listed, and participants receive airdropped rewards.

- Launchpad: This feature allows users to get in on the ground floor of new projects by committing MX tokens to receive an early allocation of the new token at a discounted price.

MEXC Registration Step-by-Step

- Sign Up: MEXC Registration (2-minute process)

- Deposit: Crypto or credit card (5% fee for fiat)

- Trade:

- Buy spot coins with 0% fees (maker orders)

- Set up copy trading portfolios

- Withdraw: 0.0005 BTC network fee

Who Should (or Shouldn’t) Use MEXC?

Ideal for:

Altcoin Hunters & Early Investors

Active/Diversified Traders

Privacy-Conscious Users

Pro Traders

Why

Access to newly listed tokens before other platforms

Low fees with 0 % maker, deep liquidity, leverage options

Trade up to 10 BTC/day without KYC

Advanced charting, bots, copy trading, demo features

Avoid If:

- You need fiat withdrawal support or deposit insurance

- You’re US/UK/Canada resident — geo-restricted

- You want quick live support or easier UI

- You prefer regulated exchanges (Coinbase, Kraken)

For Serious Traders:

“MEXC is the best-kept secret for altcoin trading—just avoid keeping large balances long-term.”

– CryptoScobra Trading Team, [Current Month] 2024

Risk Disclaimer

*Cryptocurrency trading carries substantial risk. 79% of retail traders lose money on derivatives platforms. This review represents our team’s experience after testing $50,000+ in live trades—not financial advice. Always:

Never invest more than you can afford to lose*

Enable 2FA

Final Verdict

Our Verdict: MEXC is a crypto exchange powerhouse, renowned for its almost unbelievable selection of over 2,100 cryptocurrencies. This, combined with its highly competitive 0% spot fees and futures fees of 0% maker and 0.01% taker, makes it a paradise for altcoin hunters and active traders. While the platform’s regulatory status is less clear than that of its publicly-traded rivals, its robust security features, high-leverage futures market, and optional KYC policy create a compelling and feature-rich trading environment that’s hard to ignore.

MEXC stands out in 2025 as the go-to platform for altcoin aficionados and seasoned traders:

- Best-in-class altcoin exposure with thousands of listings

- Highly competitive fees, especially with MX token savings

- Full-featured tools for professional-level strategy execution

- Reliable security framework with regular audits

But its niche focus and regulatory gaps make it less suited for casual or fiat-focused traders. For anyone hunting new tokens, trading at scale, or leveraging synthetic tools, MEXC remains a top-tier choice. Just start with small positions, use strong security measures (2FA, whitelisting), and only hold significant balances in cold storage.

MEXC Exchange: Frequently Asked Questions (2025)

Is MEXC better than KuCoin for altcoins?

Yes – 300+ more listings and earlier access.

How to avoid fees completely?

Trade >$50k monthly for VIP 0% taker fees.

Where Is MEXC registered?

MEXC is registered in Victoria, Seychelles

Does MEXC work in the USA?

MEXC has restrictions on operating in the USA, not providing KYC and putting limits on payment methods and withdrawals.

Is MEXC Safe?

Yes, MEXC is subject to AML, CTF, and KYC policies, as well as providing 2FA, and applies multi-signature and offline signatures for digital assets in cold wallets. encounter.

Is KYC Mandatory for MEXC?

KYC is not required if you have a sufficient daily withdrawal limit of 20 BTC and do not need deposit methods such as Bank Cards and Bank Transfers.

Why Is MEXC Worth Considering?

A very wide range of assertions, a large selection of launch assertions and promos, and very low fees relative to competitors.

MEXC Review (2025): Is It a Safe and Legit Exchange?

Is MEXC a trustworthy crypto exchange? Our updated 2025 review covers fees, security features, and user ratings. Get the facts before you sign up.

Product Brand: mexc

4

Pros

- My favourite exchange

Cons

- could be more detailed

- lacks additional plugins

1 thought on “MEXC Review 2025 – Is This Crypto Exchange Safe & Reliable?”

Comments are closed.