Want to level up your Profitable crypto trading strategy? Or maybe you’re trying to figure out if now is the time to dive into the markets for day trading?

If you are a crypto trading enthusiast and feel misplaced within the world of intricate trading strategies for crypto and uncertain markets, this article shall clear up your beliefs of confusion. Indeed, the world of crypto trading may seem like a very foreign and very complicated place to begin with. Still, after understanding the different trading strategies and tools one is supplied with, it is not that hard at all.

In this post, I’ll share the top cryptocurrency trading strategies you can easily adopt and implement in your trading on Multi HODL and beyond.

Bonus for you too! Read the entire article, and at the end, you’ll find me sharing a fantastic passive income source you can use with any trading strategy you want to pair it with.

Table of Contents

Profitable Crypto Trading Strategy

The crypto trading realm has grown exponentially with various traders and investors who aim to profit from the volatile but highly potential market. With a proper profitable crypto trading strategy, one is guaranteed to maximize returns while at the same time minimizing risks.

This comprehensive guide will give insights into various profitable crypto trading strategy, concepts, and tools that can help in going about the dynamic world of crypto trading.

Profitable Crypto Trading Strategy

Profitable Crypto trading strategy are essential to help any trader sail through the ever-volatile cryptocurrency market. The core concept behind all profitable crypto trading strategy is to provide a roadmap to the trader for making informed decisions to maximize profits. We will see a few of the most popular profitable crypto trading strategy below.

1. HODL

The simplest, most popular crypto trading strategy is HODL. It literally means holding on to your cryptocurrency assets for an extremely long time, regardless of ups and downs in the market.

HODL works under the principle that, with time, the value of cryptocurrencies is going to appreciate very fast, and people who patiently hold their investments will gain large profits.

2. Scalping

Scalping is one of the ways by which a trader makes money on small price movements within the market.

This strategy requires very fast decision-making and is mostly utilized at the core of very liquid markets. Scalpers can open several trades during the day, netting small profits.

3. Arbitrage

Since it is based on the discrepancies between different cryptocurrency exchanges, arbitrage requires one to buy crypto at a low price in one platform and sell it at a high price in another.

This crypto trading strategy would thus require speed and precision since most price discrepancies are very short-lived.

4. Day Trading

Day trading is when traders buy and sell cryptocurrencies within one day. One wants to profit from the short-term price movements, and all positions are closed prior to the market close.

Day traders depend almost solely on technical analysis and trends within the market.

5. HFT Trading

High-Frequency Trading is among the more advanced profitable crypto trading strategy, whereby the algorithms execute a great number of trades at an ultra-high speed.

Through this method, HFT traders are therefore able to derive profit from small inefficiencies in price in the market. This strategy requires very sophisticated technology and is hence normally employed by institutional traders.

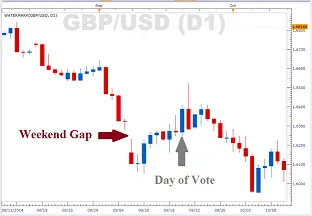

6. Range Trading

Range trading refers to the act of buying and selling digital currencies within a predetermined price range.

Traders establish boundaries in which to trade by using support and resistance levels. The strategy works best in stable markets, where prices move sideways.

7. Crypto New Issues

If, yes, the project takes off; then that is an investment that can be extremely profitable, going by history, with new crypto issues or Initial Coin Offerings (ICOs).

Most new projects do not make it through; hence, this approach is very risky. A very important practice in new crypto asset investment is the research one has to undertake, in detail, before venturing into one.

8. Moving Average Crossover

One of the approaches within technical analysis is the moving average crossover strategy, whereby traders rely on moving averages to identify buy or sell signals.

A crossover happens whenever a shorter moving average moves either above or below the longer moving average, hence indicating a change in trend.

9. Trend Trading

Trend trading is a strategy that involves identifying and following the direction of the market trend.

Traders buy when the market is trending upwards and sell when it’s trending downwards. This strategy requires a deep understanding of market cycles and technical analysis.

10. Long Straddle

A long straddle involves buying both a call and put option at the same strike price.

This strategy is used when a trader expects significant volatility in the market but is unsure of the direction. Profits are made if the price moves significantly in either direction.

11. Technical Analysis

Technical analysis involves using historical price data, charts, and other tools to predict future price movements.

Traders use technical analysis to identify patterns and trends that indicate potential buying or selling opportunities.

12. High Volatility

High-volatility trading strategies take advantage of extreme price swings in the market.

A system of trade such as this is quite dangerous but pays off as long as everything goes right. Traders use volatility indicators as a way to time their entry and exit decisions in the market.

13. Swing Trading

Swing trading is an investment strategy whereby a trader holds the position for a few days or several weeks to realize some profit from the expected price movements.

It borrows aspects of day trading and long-term investment, with an increased application of technical analysis in spotting opportunities.

14. RSI

The Relative Strength Index is a momentum oscillator. In technical analysis, it is applied to monitor and compare price movements’ speed and change.

It helps to identify overbought and oversold conditions among the crypto masses, and traders can use this to their advantage to time entries.

What are Crypto Trading Strategies?

Profitable crypto trading strategy are steps and processes that traders use to sell or buy cryptocurrencies in ways that give them the highest profit while minimizing risks.

A strategy may be based on the trends moving the market, technical indicators, or even fundamental analysis. The key to success within this highly volatile crypto market lies in understanding and applying the appropriate crypto trading strategies in a timely manner.

Risk Management

Any profitable crypto trading strategy requires risk management, which involves identifying, analyzing, and mitigating risks associated with the trade.

Effective risk management strategies can really help safeguard your capital and ensure its long-term profitability. Common risk management techniques include stop-loss orders, portfolio diversification, and limitation of leverage.

Diversification

Diversification is done by spreading an investment across different cryptocurrencies or asset classes to avoid any one investment from affecting the portfolio due to poor performance.

This very diversified portfolio will help investors sail through market volatility, thereby reducing high chances of broad losses. By implementing a diversified strategy, investors can potentially benefit from the growth of various cryptocurrencies while mitigating the risks associated with individual assets. This approach allows for exposure to different blockchain technologies, use cases, and market segments within the crypto space.

Moreover, diversification can extend beyond cryptocurrencies to include traditional assets like stocks, bonds, and commodities.

Technical and Fundamental Analysis

Both technical and fundamental analyses are critical to crypto trading. Technical analysis would involve studying past price charts and indicators to predict further pricing activity.

Fundamental analysis majorly focuses on intrinsic value concerning technology, team, and market demand associated with the cryptocurrency. But using both approaches shall make your Profitable crypto trading strategy much more sophisticated. By combining these two methods, traders can gain a comprehensive understanding of a cryptocurrency’s potential.

Technical analysis helps identify entry and exit points, support and resistance levels, and overall market sentiment. Meanwhile, fundamental analysis provides insights into the long-term viability and growth prospects of a project.

Implementing both approaches allows traders to make more informed decisions, reducing the risk of emotional trading. For instance, a coin might show bullish technical indicators, but fundamental analysis could reveal underlying issues with the project’s development or adoption.

Automated Crypto Trading

Automated crypto trading makes use of algorithms and trading bots that enact trades on your behalf.

Such bots are in a position to analyze market data, execute trades, and manage your portfolio with minimal human involvement. This will be very useful for traders who do not have much time or expertise to monitor the market continuously.

One of the key advantages of automated crypto trading is its ability to operate 24/7, capitalizing on opportunities that human traders might miss due to time constraints or the need for sleep.

Advantages of Automated Trading

The system provides speed, accuracy, and even complex strategies without interference from human emotions.

Such bots can operate around the clock and exploit market opportunities when one is not actively trading. However, one needs to select a reliable bot and then regularly monitor its performance to make sure it is aimed at one’s trading goals. Moreover, algorithmic trading bots can analyze vast amounts of data in milliseconds, identifying patterns and trends that human traders might miss.

This capability allows for more informed decision-making and potentially higher profits. The ability to backtest strategies using historical data is another significant advantage, enabling traders to refine their approaches before risking real capital.

However, it’s crucial to understand that while trading bots offer numerous benefits, they are not infallible.

Selecting the Right Trading Bot

While one is engaged in automated cryptocurrency trading, care should be exercised in the choice of a trading bot. Key factors are to be investigated and balanced meticulously so that the bot chosen turns out to be suitable for your specific trading needs and preferences.

First, note the reputation of the bot among the crypto traders, which gives insight into its reliability, performance, and customer satisfaction. Moreover, the bot has to be assessed for its usability and user-friendliness since you will rely on it for monitoring, configuration, and management of your automated trading.

It is equally important to verify that the bot supports the cryptocurrency exchanges you are going to use and the key trading strategies that suit your needs based on investment goals and risk tolerance.

Portfolio Management and Performance Tracking

No doubt, effective portfolio management is what forms the backbone of success in the long run, more so in a dynamic and volatile world like cryptocurrency trading. This all boils down to a very critical practice: periodic reviewing and optimization of one’s digital asset holding in respect to market conditions being perpetually in flux.

It means that one reviews the composition of their portfolio and its periodic performance to make informed decisions with respect to adjustment in trading strategies. You will need to justify trading strategies, taking advantage of new opportunities or maybe minimizing possible risks.

Portfolio management strategies should be inculcated in a disciplined way when attending to crypto traders, who are working with vastly unpredictably changing markets, to secure constant and consistent gains. This process of systematically tracking and analyzing your holdings provides invaluable insights that will be useful for any future trading decisions, allowing you to strategically realign your strategies and positioning with ever-changing market trends.

This is among the key factors that differentiate successful portfolio managers who trade cryptocurrencies sensibly from those who can hardly keep a consistent track record in the long term.

Periodic Portfolio Rebalancing

Periodic portfolio rebalancing is crucial for the cryptocurrency investor seeking to sustain his or her desired risk profile and to keep aligned with his or her long-term trading objectives.

This process is classified as the systematic readjustment process of the size of different asset classes in the investment portfolio in order to counter drift, which is a common problem since several investments tend to perform differently from time to time. The overperforming ones are sold, whereas the underperforming ones are bought with the selling proceeds in order to manage and maintain balance and diversification without introducing risks due to uneven market movements.

To this end, rebalancing at regular intervals can be a very good tool for sticking to carefully built cryptocurrency trading strategies. This disciplined approach not only brings down the overall risk exposure of the portfolio but also serves to lock in gains from high-performing assets, at the same time giving opportunities to get hold of the recovery potential of undervalued investments.

Ultimately, periodic portfolio rebalancing could prove a very potent tool for cryptocurrency traders committed to prudent risk management and the attainment of financial objectives in the long term.

Performance Metrics

Tracking performance metrics is essential for evaluating the success of your Profitable crypto trading strategy. Key metrics to monitor include your return on investment (ROI), risk-adjusted returns, and drawdown levels. Analyzing these metrics can help you identify areas for improvement and refine your trading strategies over time.

Tips for Successful Crypto Trading

To succeed in crypto trading, it’s important to develop a solid Profitable crypto trading strategy and stick to it. One key aspect of this strategy should be thorough research and analysis of potential investments. This involves studying market trends, understanding the technology behind different cryptocurrencies, and staying informed about regulatory changes that could impact the market.

Here are some tips to help you achieve success in the market:

Staying Informed

Stay updated on the latest news and developments in the crypto space. Market sentiment and news can have a significant impact on crypto prices, so staying informed is crucial for making timely decisions.

DevelopeTrading Plan

Create a detailed trading plan that outlines your goals, strategies, and risk management techniques. Having a plan in place can help you stay disciplined and avoid making impulsive decisions.

Emotional Control

Emotions like fear and greed can lead to poor trading decisions. It’s important to maintain emotional control and stick to your trading plan, even during periods of high market volatility.

What are the Best Crypto Trading Strategies?

The best Profitable crypto trading strategy depend on your trading style, risk tolerance, and market conditions. For beginners, strategies like HODL and range trading can be effective. More experienced traders may prefer advanced strategies like scalping, arbitrage, or automated trading.

Ultimately, the key to success is finding a strategy that aligns with your goals and sticking to it.

Best Profitable Crypto Trading Strategy for Beginners?

First of all, beginners should understand the basics and most indispensable concepts of crypto trading. Never start with a huge investment; always start small and increase your investment with experience. Demo accounts or paper trading will allow the practice for beginners without putting real money at stake.

Can Technical Analysis Improve Crypto Trading Strategies?

Yes, technical analysis can complement your cryptocurrency trading strategies on an enormous scale by giving clues to market trends, price patterns, and potential entry and exit points. Inclusion of technical analysis in your trading strategy will help you in decision-making and improve your chances of success.

What Role Does Risk Management Play in Crypto Trading?

Risk management is crucial in crypto trading, as it helps protect your capital and reduce the likelihood of significant losses. By implementing effective risk management techniques, such as setting stop-loss orders and diversifying your portfolio, you can safeguard your investments and ensure long-term profitability.

One key aspect of risk management in crypto trading is position sizing. This involves carefully determining the amount of capital to allocate to each trade based on your overall portfolio size and risk tolerance. By limiting the size of individual positions, you can prevent a single trade from causing catastrophic losses.

Another important strategy is to use leverage judiciously. While leverage can amplify profits, it also magnifies losses. Experienced traders often recommend using no more than 2-3x leverage, especially for beginners. This approach allows you to benefit from market movements while minimizing the risk of liquidation.

How to Identify Trends for Effective Profitable crypto trading strategy?

Proper identification and interpretation of the trend remain as one of the basic pillars of a Profitable crypto trading strategy linked to successful cryptocurrency trading. Experienced traders make wide use of the multitude of technical analysis tools and indicators to help in detecting emerging trends and in the general direction of the market.

Techniques that fit under the same description of popularity as this one can involve moving averages to smooth fluctuation out and define the trend, drawing trendlines to emphasize the existence of support and resistance areas, and applying momentum indicators such as the Relative Strength Indicator or the Moving Average Convergence Divergence to confirm strength and direction.

That way, traders are able to apply technical analysis in an efficient manner and derive related valuable hints of the nature of the present market structure, positioning trading strategies in such a way to get maximum benefits from the foreseen price movements. By its identification through an aligned trading approach, investors can maximize profits and minimize losses, hence making it one of the key competencies of any serious crypto trader.

What are the Key Indicators to Watch for in Crypto Trading?

The key technical indicators are some of the important tools to be applied in crypto trading, giving insight into market dynamics and trends. For example, MAs will explicitly show the trend and momentum in an asset’s price, while the RSI would define whether or not it is oversold or overbought.

The Moving Average Convergence Divergence indicator is excellent in picking out possible trend reversals, while Bollinger Bands could be used to outline volatility and price channels. It would also be imperative to have a record of trading volume, as this would be an indication of strength and conviction behind a market move.

It is in the careful analysis and combination of diversified indicators that crypto traders will be able to arrive at a comprehensive view of the market, hence making more informed and strategic decisions. It is within such multifaceted strategies that one would be able to enhance the accuracy and effectiveness of trading strategies in ensuring better risk management and finally better overall performance in these quite volatile and dynamic cryptocurrency markets.

Check Out Momentum Radar Now!How Does Market Sentiment Influence Crypto Trading Strategies?

Market sentiment is one of the major factors playing a very key role in cryptocurrency trading strategies. The general mood and perception of various market participants, as reflected through the different sentiment indicators, could have a profound effect on price movements of digital assets.

If positive, characterized by optimism and confidence, the market sentiment could fuel the price upward since investors will be more inclined to buy and hold cryptocurrencies. In contrast, negative sentiments characterized by fear, uncertainty, and doubt can result in sell-offs and cause downward price pressure because traders and investors are becoming more risk-averse.

This can be achieved by constantly monitoring social media discussions, news reports, and specialized sentiment indicators to understand the sentiment at any given time. With this information, cryptocurrency traders would be better placed to project what might happen in markets and thus make more informed decisions on trading strategies.

It is at this point that traders can readjust their positions, risk management, and trading tactics in a bid to take advantage of changing sentiment and market dynamics for enhancing their chances of success within such volatile and fast-changing cryptocurrency markets.

What are the Most Common Mistakes in Crypto Trading?

Probably one of the best ways is to start paper trading or practice the strategies on a demo account. This keeps an individual from losing real capital while gaining experience and confidence before going into the live market. The risk can also be hedged by diversification across different classes of cryptocurrencies and various asset classes, which will also increase the expected returns.

One needs to keep track of the market trends, changes in regulations, and technologies in crypto at all times. However, beware of the hype or acting because of FOMO. Rather, focus on the fundamentals and technical indicators to the best of your ability in making decisions.

Setting realistic profit targets and stop-loss orders can help keep the balance of your investments intact and avoid emotional decisions during times of market volatility. Consistency, after all, is a major part in crypto trading. In the long run, small but steady gains often turn out to be more productive compared with dangerous, high-stake trades.

How Do You Manage Risk Effectively in Crypto Trading?

Effective risk management in crypto trading involves setting stop-loss orders, diversifying your portfolio, and limiting leverage. It’s also important to only invest what you can afford to lose and avoid taking unnecessary risks. By managing risk effectively, you can protect your capital and ensure long-term success. Another crucial aspect of risk management in crypto trading is staying informed about market trends and news.

Regularly researching and analyzing market data can help you make more informed decisions and anticipate potential risks. Additionally, using dollar-cost averaging as a strategy can help mitigate the impact of market volatility on your investments.

It’s also wise to consider the security of your digital assets. Utilizing hardware wallets and implementing strong authentication measures can protect your investments from hacking attempts and theft. Furthermore, keeping a portion of your portfolio in stable coins or fiat currencies can provide a buffer against sudden market downturns.

Developing a clear trading plan and sticking to it is essential for managing emotional decision-making, which can often lead to increased risk. This plan should include specific entry and exit points, as well as criteria for adjusting your strategy based on market conditions. By adhering to a well-thought-out plan, you can avoid impulsive trades and maintain a disciplined approach to risk management.

What are Some Popular Indicators Used in Crypto Trading Strategies?

Popular indicators employed with a Profitable crypto trading strategy would be the Relative Strength Index, Moving Average Convergence Divergence, Bollinger Bands, and Fibonacci retracements. These indicators help to identify the trends, momentum, and possible reversal points in the market.

Therefore, they make an income-related component of formulating market-beating strategies for crypto trading. When properly combined, these tools can give an insight into the dynamics of the markets. For example, RSI can indicate overbought or oversold conditions, while the MACD is very useful for identifying changes in trends and shifts in momentum. Bollinger Bands convey useful information related to volatility and potential price breakouts, whereas Fibonacci retracements assist in making out the vital support and resistance levels.

Advanced traders often incorporate more than one indicator in developing an all-round trading strategy. Through the use of those indicators, one can combine them with fundamental analysis and market sentiment to possibly make better decisions and increase the success rate. There is no indicator that will work completely; it takes constant learning and adaptation to the market, as well as management of risks, to become successful when trading.

Moreover, that has developed into the extensive utilization of crypto-specific indicators, such as the Network Value to Transactions (NVT) ratio and the Puell Multiple, toward offering distinctly unique insights regarding blockchain-based assets. These indicators involve on-chain data amounts, proliferating into slightly deeper interpretations compared with traditional technical analyses of cryptocurrency markets.

How Does Fundamental Analysis Impact Crypto Trading Decisions?

Fundamental analysis is essential for cryptocurrency investors who want to be well-informed and strategic about their investment decisions. The traders can establish essential hints that help in guiding trading activities by correctly estimating the intrinsic value of a given cryptocurrency.

Very likely, the in-depth analysis will go through factors such as the underlying technology that is driving this project, the expertise and track record of the development team, the level of market demand and adoption, and the competitive landscape within the broader cryptocurrency space.

This will enhance the investors’ ability to form a better perception of the real value and long-term growth potential of a cryptocurrency, rather than just focusing on short-term market fluctuations or speculative frenzy.

With information at one’s fingertips, one could then confidently take well-informed decisions about which cryptocurrency or cryptocurrencies to deploy capital in and at what time a position should be entered or exited. Ultimately, this fundamental analysis will help insights in the rough, volatile, and unpredictable cryptocurrency markets.

What are the Advantages of Automated Trading in Crypto?

Automated trading in the cryptocurrency market offers a set of advantages that definitely make it attractive to investors and traders. One of the main reasons behind this is the capability of traders to trade at very high speeds and execute trades that help capture market opportunities before the time window closes, which would not be possible for a manual trader to experience and gain an advantage.

The other key benefit derived in the use of automated trading systems is their immunity to emotional biases and impulses, which often distort human judgment, hence making these systems capable of executing disciplined data-driven strategies, which maybe have the potential to yield more consistent and profitable outcomes.

With crypto exchanges being open 24/7, trading platforms equipped with such systems can constantly check out the markets for best conditions to trade at that very moment and then take relevant actions on their findings, even if their user isn’t engaged in the process.

These automated solutions are thus able to take advantage of opportunities that otherwise might have bypassed those using manual and episodic trading. This provides investors with an edge within the dynamic and highly volatile landscape of cryptocurrencies through leveraging the speed, objectivity, and tireless dedication that automated trading provides.

How Do You Choose the Right Cryptocurrency for Your Strategy?

Choosing the best cryptocurrency(s) for investment or trading is one of the major decisions. It needs to be based on a careful evaluation of some major factors. The market capitalization of any cryptocurrency does inform about its overall size and level of adoption, and liquidity measures the ease with which an asset can be bought or sold without materially affecting its price.

Another important consideration would be the volatility, which represents a change in prices, more relevant for short-term traders. Proper assessment of the fundamental strengths of a cryptocurrency project—technologies, teams, roadmaps, and use cases in real life—may help create a distinction between promising long-term investment candidates and mere speculation.

Tailor your cryptocurrency choices in such a manner that it aligns with your risk appetite and some trading objectives to have a well-diversified portfolio that keeps overall risk low while positioning to take advantage of the immense growth potential residing within the digital asset market.

What Role Does Patience Play in Successful Crypto Trading?

Successful and Profitable crypto trading strategy requires unwavering patience and discipline. The cryptocurrency markets are inherently volatile, with prices often fluctuating rapidly and unpredictably. It is crucial for traders to resist the temptation to make hasty, impulsive decisions and instead focus on executing their well-researched trading strategies.

By patiently waiting for the right market conditions and opportunities to present themselves, traders can avoid the pitfalls of emotional decision-making, which can result in costly losses. Maintaining patience and steadfastly adhering to a thoughtful, methodical trading plan is a hallmark of the most successful crypto traders.

This measured approach, coupled with a willingness to be patient and let the market unfold, is essential for navigating the dynamic and sometimes chaotic crypto ecosystem and achieving sustainable trading profits over the long term.

How Do You Adjust Your Strategy in Volatile Market Conditions?

In case you find yourself facing volatile markets, it is essential to adjust one’s trading strategy accordingly. To put it differently, if you deal with an extremely unstable and unpredictable market, it is advisable to review position sizes.

This may reduce your exposure to oversized losses when the markets are not moving in your favor. Second, raising the stop-loss levels can help decrease downside risk. Trades can be automatically cut at predetermined points in prices to avoid further erosion of the account balance.

Also, by switching to a more conservative strategy—the trading of lower-risk, purely defensive positions—this would allow you to sail through such turbulent markets and protect your hard-won gains. One should always be flexible and adaptable to the strategy so that one is able to turn and change the activities involving trading as soon as possible in accordance with the current dynamics. In this way, adjustments can be proactive, and better care can be taken toward guarding capital for capitalizing on profitable opportunities amidst volatile markets.

What are the Benefits of Diversification in Crypto Trading?

Another good way of tempering the inherent risks involved in investing in cryptocurrencies—a very volatile and dynamic market—is diversification. This can be achieved simply by diversifying crypto investments into various digital currencies or asset classes, which lowers the prospects for big losses resulting from underperformance by one digital asset.

This diversified approach ensures that your portfolio does not have an overreliance on the fortunes of any single cryptocurrency, hence protecting it against unpredictable fluctuations characteristic in the crypto ecosystem.

Another advantage that comes from a diversified portfolio includes taking advantage of differing market opportunities that such a diversified range of cryptocurrencies and related assets might offer. Diversification is an important facet of investment—considering the different price action and growth curves possible for various digital currencies and asset classes.

Such diversified strategies let you take part in the upside potential of multiple market segments, enhancing your risk-adjusted return over the long term. With this balanced approach, you will manage risks more confidently and with added resilience against volatility.

How Do You Stay Updated on Crypto Market Trends and News?

Staying updated on crypto market trends and news involves following reliable news sources, subscribing to market analysis newsletters, and participating in online communities.

Social media platforms like Twitter and Reddit can also provide valuable insights, but it’s important to verify information from multiple sources.

What are the Psychological Aspects to Consider in Crypto Trading?

Psychological factors can exert a profound influence on one’s crypto trading performance, and it is crucial to recognize and address these underlying influences. Emotions such as fear, greed, and overconfidence can often cloud judgment and lead to impulsive, irrational decision-making, ultimately undermining the effectiveness of one’s trading strategy.

To achieve consistent, long-term success in the volatile crypto markets, it is essential to cultivate a disciplined, emotionally-balanced mindset.

By maintaining emotional control and adhering strictly to a well-developed trading plan, traders can avoid the pitfalls of reacting to short-term market fluctuations driven by sentiment rather than fundamental analysis. This disciplined approach allows traders to remain objective, make informed decisions, and weather the inevitable ups and downs of the crypto landscape.

How Do You Create a Disciplined Trading Routine for Success?

The first step to predictable success in the markets is creating for oneself a disciplined, structured trading routine. Setting defined, measurable goals that provide direction for one’s trading activities is where all of this must start.

This process will involve the planning of an overall trading strategy, coupled with detailed strategies, risk management protocols, and decision-making frameworks. The key is then maintaining unwavering adherence to this plan, executing your trades with discipline and precision, rather than giving in to impulse or emotion.

One must also be sure to review one’s trading performance regularly, not only during and after successes but also when one fails, to continue to improve and be fine-tuning one’s strategy. Keeping abreast of recent market trends, economic indicators, and the developments happening in industries will also arm you with the contextual knowledge necessary for making informed, strategic trading decisions.

Perhaps more important, however, is developing emotional control and avoiding Charybdis—fear, greed, and overconfidence—to sustain a level head and a rational trading mindset. By integrating these elements seamlessly into one cohesive, disciplined routine, traders can set themselves up for long-term, sustainable success within the dynamic and challenging financial markets.

What are Some Strategies for Maximizing Profits While Minimizing Losses?

Another crucial strategy is to implement proper risk management techniques, such as position sizing and maintaining a favorable risk-to-reward ratio. This approach helps protect your capital while allowing for potential gains. Additionally, staying informed about market trends and economic indicators can give you a competitive edge. It’s essential to develop a trading plan and stick to it, avoiding emotional decision-making that can lead to impulsive trades.

Utilizing leverage judiciously can amplify profits, but it’s important to understand the associated risks. Regular portfolio rebalancing ensures that your investments align with your goals and risk tolerance. Lastly, continual education and adaptation to evolving market conditions are key to long-term success in maximizing profits and minimizing losses.

How Do You Evaluate the Performance of Your Crypto Trading Strategy?

One crucial aspect to consider is the consistency of your returns over time. A strategy that produces steady, positive results across various market conditions is generally more reliable than one with sporadic, high-volatility gains. Additionally, comparing your strategy’s performance to relevant benchmarks, such as major cryptocurrency indices or traditional market indicators, can provide valuable context.

It’s also important to assess the strategy’s behavior during different market phases, including bull runs, bear markets, and periods of high volatility.

This analysis can reveal how well your approach adapts to changing conditions and whether it requires fine-tuning for specific scenarios. Furthermore, examining the correlation between your strategy’s performance and external factors, such as regulatory news or macroeconomic events, can offer insights into potential vulnerabilities or opportunities.

How Can Social Media Influence Crypto Trading Strategies?

This makes social media one of the most influential forces able to shift a Profitable crypto trading strategy and cause changes in market dynamics.

The huge extent of online discussions and the sharing of information on various online forums, including Twitter, Reddit, and Telegram, exerts a great influence on the overall sentiment towards cryptocurrencies—this then can lead to price movements and drive trading decisions. Sensible traders in cryptocurrencies keep up with news, trends, and opinions that may have an impact on the market through these social media channels.

On the other hand, the traders have to be very cautious and resort to due diligence based on such social media-driven information. Unchecked spreading of unsubstantiated claims, rumors, and speculative narratives can result in impulsive, hence probably not well-thought-out, trading actions.

Traders have to teach themselves to objectively judge the source and credibility of the information received from social media and thereby establish fact from fiction. It is also important not to act impulsively to online hype or sentiment. Adopting a middle-way approach, being well-informed, shall enable traders to exploit the cues and sentiments obtained from social media sites while treading down the potential risks of unchecked influence exerted by the market.

What are the Advantages and Disadvantages of Leverage in Crypto Trading?

Leverage allows traders to amplify their positions by borrowing funds, potentially increasing profits. However, it also increases risk, as losses can be magnified. It’s important to use leverage cautiously and ensure that you have a solid risk management strategy in place to protect your capital.

When used wisely, leverage can be a powerful tool for experienced traders looking to maximize their market opportunities. It’s crucial to understand that while leverage can amplify gains, it can also lead to substantial losses if not managed properly. To mitigate risks, traders should consider implementing stop-loss orders and regularly monitoring their positions.

Additionally, it’s advisable to start with lower leverage ratios and gradually increase them as you gain more experience and confidence in your trading strategies. Diversifying your portfolio and avoiding over-leveraging on a single asset can also help spread risk. Remember, successful leveraged trading requires discipline, continuous education, and a thorough understanding of market dynamics.

Before engaging in leveraged trading, it’s essential to thoroughly research and practice with demo accounts. This approach allows you to gain valuable experience without risking real capital. Always stay informed about market conditions and be prepared to adjust your strategy as needed. By combining careful planning, ongoing education, and prudent risk management, traders can harness the potential benefits of leverage while minimizing its inherent risks.

How Do You Manage Emotions Like Fear and Greed in Crypto Trading?

Effective management of the powerful emotions of fear and greed lies at the heart of successful crypto trading. A disciplined long-term view must be kept to manage the intrinsic volatility of cryptocurrency markets. A well-written trading plan that spells out goals and risk management protocols can help in keeping one on the path by avoiding impulsive decisions based on short-term fluctuations in the market.

It means developing a robust, self-disciplined mindset that can help traders keep cool and calm their heads amidst any extensive market fluctuations that may result from mass panic or irrational exuberance. By staying true to their overall trading strategy and acting in a manner inconsistent with their plan, crypto investors can dampen the negative impact of emotional decision-making on investment performance and support a sustainable, profitable outcome over time.

Needless to say, this forms one of the major hallmarks of the most successful, seasoned traders when approaching crypto markets with a measured, unemotional approach.

What are the Best Practices for Portfolio Management in Crypto Trading?

Effective portfolio management is important in enabling one to gain long-term success in the rather volatile and dynamic world of cryptocurrency trading. This well-structured and disciplined approach in managing portfolios provides an edge for crypto investors to navigate intrinsic risks and uncertainties in this fast-moving market.

One of the major best practices involved in the Profitable crypto trading strategy is portfolio management process is diversification. It reduces the effect of individual-asset volatility and minimizes the overall risk of a portfolio by spreading the capital over a diverse range of different cryptocurrencies, blockchain projects, and types of assets.

This will also help in regular rebalancing of the portfolio, enabling one to maintain the target allocation to and exposure towards assets as desired, while changing with the market conditions.

Coupled with diversification and rebalancing, keeping track of the market trends and performance becomes very important. One should be updated on new technologies, regulatory changes, and market sentiment to further identify opportunities and adjust one’s portfolio accordingly. As the market dynamics continue to evolve, one will be better positioned to take advantage of conducive conditions and reduce the worst consequences that could arise from market downturns.

A disciplined, data-driven approach to portfolio management is foundational to enduring success in cryptocurrency trading. By integrating these best practices into an investment strategy, one gains confidence and achieves financial goals by enhancing the management of the underlying complexities and volatility of the crypto markets.

What are the Potential Regulatory Challenges Facing Crypto Traders?

Of the myriad of regulatory challenges that surround this fast-moving digital asset landscape, crypto traders have to contend with issues that immensely affect their trading activities. One major consideration in that respect would be probable changes to taxation laws, impacting the financial obligations and reporting requirements for cryptocurrency investors.

It can set limits on specific trading practices that are perceived as especially risky, such as leveraged positions or dealing with specific types of digital assets. In addition, the crypto space has come under increased scrutiny by regulatory bodies that become very vigilant over the acts in the market and their actors to ensure adherence to the applicable laws and the integrity of the financial system.

With the regulatory environment of cryptocurrencies constantly changing and, at times, remaining highly complex, it is for the crypto traders to maintain vigil and be well informed regarding the rules and regulations of their jurisdiction. One would certainly be better prepared to overcome these challenges and reduce the risk of non-compliance, tending to result in heavy fines, legal penalties, and disruption of trade practices by keeping a close watch on the regulatory developments and adhering very strictly to all applicable laws and guidelines.

What Role Does Liquidity Play in Choosing Assets for Trading?

When selecting assets for your trading activities, liquidity is a critical factor to carefully consider. Liquidity refers to the ease with which an asset can be bought or sold without causing substantial changes in its price. Highly liquid assets are generally preferred by traders, as they can be more readily converted into cash or other financial instruments without incurring significant price impact.

The level of an asset’s liquidity can have a significant impact on the efficiency and profitability of your trading strategy. Highly liquid assets, such as the stocks of large, well-established companies or major currency pairs, tend to be easier to trade, with narrower bid-ask spreads and lower transaction costs. This allows traders to enter and exit positions more seamlessly, minimizing the risk of slippage – the difference between the expected price of a trade and the actual price at which the trade is executed.

In contrast, assets with low liquidity, such as thinly-traded stocks or exotic currency pairs, can be more challenging to trade. The lack of sufficient market activity and depth can lead to wider bid-ask spreads, higher transaction costs, and increased price volatility. This can result in slippage, where the actual execution price deviates from the anticipated price, potentially eroding your trading profits.

Therefore, it is crucial to carefully assess the liquidity of any assets you intend to trade, ensuring that they align with your trading strategy and risk tolerance. By selecting assets with adequate liquidity, you can enhance the efficiency and reliability of your trading activities, ultimately improving your chances of achieving consistent and favorable trading outcomes.

How Do You Assess the Credibility of Crypto Trading Platforms?

Assessing the credibility of crypto trading platforms involves evaluating factors like security measures, regulatory compliance, user reviews, and the platform’s track record. It’s important to choose a platform that offers robust security features, transparent operations, and a positive reputation in the market.

Additionally, consider the platform’s fees, supported cryptocurrencies, and trading tools when making your decision. One crucial aspect to consider is the platform’s liquidity, as higher liquidity often translates to better pricing and faster trade execution.

Look for platforms that have a significant trading volume and a diverse user base. It’s also wise to examine the customer support quality, as responsive and knowledgeable assistance can be invaluable, especially for newcomers to crypto trading.

Another key factor is the platform’s insurance policies. Some reputable exchanges offer insurance coverage for digital assets, providing an extra layer of protection against potential hacks or security breaches. This can significantly mitigate risks associated with cryptocurrency trading.

Consider the platform’s integration with other financial tools and services. Advanced traders might prefer platforms that offer API access for automated trading or integration with portfolio tracking software. For those interested in long-term holding, look for platforms that provide secure wallet services or easy transfer to external wallets.

Lastly, stay informed about the platform’s future plans and developments. A platform that consistently upgrades its technology, adds new features, and adapts to market trends is more likely to remain competitive and reliable in the long run. By carefully weighing these factors, you can make an informed decision and choose a crypto trading platform that best suits your needs and risk tolerance.

Summary

One requires a well-thought-through strategy, a very disciplined approach, and continuous learning to move through the sophisticated and highly volatile crypto trading world. Having a feasible and profitable crypto trading strategy is a must for both a newcomer and an expert trader in the crypto space.

Keep yourself updated on the current market happenings. Risk management and technical as well as fundamental analysis are surely going to help you in optimizing trading strategies that will raise your profit possibilities in the crypto market over the long term.

**Disclaimer: Please remember that all investment decisions carry risk, and it’s important to conduct your own research before using any platform. This is not financial advice.