If you’ve stumbled across Marsses.com while searching for cryptocurrency staking opportunities, you’re probably wondering: Is Marsses legit, or is it just another crypto scam? This comprehensive Marsses review digs into real user experiences, third-party safety checks, red flags, and everything you need to know before investing your hard-earned money.

Sign up for MarssesTable of Contents

Quick Verdict: Should You Trust Marsses?

⚠️ Proceed with Extreme Caution

Marsses.com presents itself as a cryptocurrency staking and node validation platform promising daily returns between 0.48% to 0.88%. However, multiple red flags and mixed trust scores from independent security platforms suggest this is a high-risk investment that exhibits characteristics commonly associated with financial scams and HYIP (High-Yield Investment Program) schemes.

Trust Scores at a Glance:

- Gridinsoft: 53/100 (Medium Risk – Flagged as potential financial scam)

- ScamAdviser: Very Low Trust Score

- Scam Detector: 60.6/100 (Medium-Risk, Active)

- Trustpilot: 4.2/5 (18 reviews – but authenticity questionable)

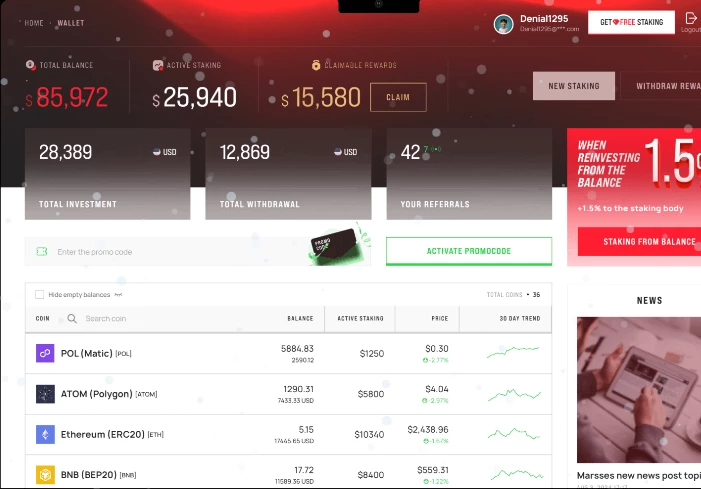

What Is Marsses? Understanding the Platform

Marsses.com markets itself as a cryptocurrency staking and node validation service that allows users to earn passive income by staking popular cryptocurrencies including:

- Ethereum (ETH)

- Bitcoin (BTC)

- Cardano (ADA)

- Solana (SOL)

- Polkadot (DOT)

- Binance Smart Chain (BNB)

- And 20+ other cryptocurrencies

Promised Returns

The platform advertises daily returns ranging from 0.48% to 0.88%, which translates to:

- 175% to 321% annual returns (APR)

- Some plans promise 230% returns after 365 days

These figures are astronomically high compared to legitimate staking services, which typically offer 5-20% APR.

How Marsses Claims to Work

According to their website:

- Users deposit cryptocurrency into staking pools

- Funds are delegated to “MEV-enabled validators”

- Validators auction off blockspace and receive MEV (Maximal Extractable Value) rewards

- These rewards are redistributed to the stake pool as extra APY

- Users accumulate rewards in addition to standard staking returns

Real User Reviews: What Are People Saying?

Trustpilot Reviews (4.2/5 Stars)

Marsses has 18 reviews on Trustpilot with a 4.2-star rating. However, several concerning patterns emerge:

Positive Reviews (Potentially Suspicious):

- Most positive reviews are generic, praising “fast payments,” “professional support,” and “steady growth”

- Many reviews lack specific details about actual experiences

- Several accounts have limited review history

Critical Warning – Recent Negative Review:

A user named Nepegar (January 2026) shared a damning experience:

“They promised ‘instant withdrawals,’ but the moment I clicked withdraw, my account was flagged for security review. I was told to deposit more funds to ‘verify ownership.’ That was the turning point. No legitimate platform does that.”

This is a classic scam tactic known as “advance fee fraud” – requiring additional deposits to access your funds.

Third-Party Safety Checks: What Security Experts Say

1. Gridinsoft Security Analysis

Gridinsoft’s comprehensive scan reveals critical concerns:

Trust Score: 53/100 (Medium Risk)

🚨 Key Findings:

- Blacklisted by Gridinsoft Internet Security

- Classified as “Financial Scam”

- Domain age: 3.9 years (registered March 2022)

- Uses Cloudflare hosting (common among scam sites to hide true location)

- Contains AI-generated text (suggests rapid website creation without editorial oversight)

Positive Signals:

- Valid SSL certificate

- External review system (Trustpilot)

- Social media links present

Risk Indicators:

- Blacklisted status

- Cryptocurrency-related (high-risk category)

- Registration form collecting personal data

2. ScamAdviser Assessment

ScamAdviser gives Marsses a “Very Low Trust Score” with these red flags:

Critical Issues:

- Website owner’s identity is hidden using WHOIS privacy services

- Registrar (NICENIC INTERNATIONAL GROUP CO., LIMITED) facilitates “a high number of websites that have a low to very low review score”

- Cryptocurrency services flagged as high-risk for consumers

Warning from ScamAdviser:

“We consider these kinds of services to be high-risk for consumers. Even experts in cryptocurrencies have trouble distinguishing legit digital currency services from frauds and scams.

3. Scam Detector Evaluation

Scam Detector assigns a medium trust score of 60.6/100, categorizing Marsses as:

- Active

- Medium-Risk

The platform is operational but carries significant risk factors that warrant caution.

Major Red Flags: Warning Signs You Can’t Ignore

1. Unrealistic Returns

Legitimate staking services offer 5-20% APR. Marsses promises 175-321% APR – returns that are mathematically unsustainable without a Ponzi scheme structure.

2. HYIP Classification

BestBTCSites.com identifies Marsses as a HYIP (High-Yield Investment Program) – a category notorious for Ponzi schemes that:

- Pay early investors with new investor money

- Eventually collapse when new deposits slow down

- Leave most investors with total losses

3. Hidden Ownership

The website owner uses WHOIS privacy protection to hide their identity – a major red flag for financial services that should operate transparently. But the ceo and team are on the website.

4. Withdrawal Restrictions

Multiple reports indicate:

- Accounts flagged during withdrawal attempts

- Requests for additional deposits to “verify ownership”

- Delays in processing withdrawals (1-72 hours claimed, but actual experiences vary)

5. Suspicious Review Patterns

The Trustpilot reviews show characteristics of review manipulation:

- Cluster of positive reviews posted on the same dates

- Generic praise without specific details

- Accounts with limited review history

6. MEV Rewards Explanation Doesn’t Add Up

While MEV (Maximal Extractable Value) is a real concept in blockchain, the returns Marsses claims from MEV are grossly exaggerated. Legitimate MEV strategies don’t generate 300%+ annual returns.

How to Protect Yourself: Risk Management Strategies

If you’re considering Marsses despite the warnings, follow these safety protocols:

Never Invest More Than You Can Afford to Lose

Treat any deposit as money you may never see again.

Start with Minimum Deposits

Test withdrawal functionality with the smallest possible amount before committing larger sums.

Document Everything

- Take screenshots of all transactions

- Save email communications

- Record deposit addresses and transaction IDs

Research Recovery Options

If you’ve been scammed, resources like digitalevidence bureau (mentioned in Trustpilot reviews) may help with fund recovery, though success rates vary.

Use Dedicated Wallets

Never connect your primary cryptocurrency wallet. Use a separate wallet with minimal funds for testing.

Legitimate Alternatives to Marsses

If you’re interested in real cryptocurrency staking, consider these established platforms:

Trusted Staking Services:

- Coinbase Staking – 5-20% APR on major cryptocurrencies

- Kraken Staking – Regulated exchange with transparent staking

- Lido Finance – Decentralized liquid staking protocol

- Rocket Pool – Community-driven Ethereum staking

- Native Wallet Staking – Stake directly through official wallets (Cardano, Solana, etc.)

These platforms offer realistic returns backed by actual blockchain validation mechanisms.

FAQ: Your Marsses Questions Answered

Is Marsses.com a scam?

Multiple security platforms flag Marsses as a potential financial scam with high-risk characteristics. The unrealistic returns, hidden ownership, and withdrawal issues reported by users strongly suggest this is not a legitimate investment opportunity. But with any platform never invest more then you can afford to lose.

Can I make money with Marsses?

Some early investors in HYIP schemes do receive payments (funded by new investor deposits), but the vast majority lose their entire investment when the scheme collapses. This is not sustainable income.

How do I withdraw from Marsses?

Users report withdrawal difficulties including account flags and requests for additional deposits. If you cannot withdraw, you may have been scammed.

What should I do if I’ve already invested?

Attempt to withdraw immediately. Document all interactions. If withdrawal is blocked, consider contacting fund recovery services and report the platform to cryptocurrency fraud authorities.

Are the Trustpilot reviews real?

Yes, they should be real. The negative reviews describing withdrawal issues appear more credible.

How long has Marsses been operating?

The domain was registered in March 2022 (approximately 3.9 years ago). However, longevity doesn’t guarantee legitimacy – many scams operate for years before collapsing.

Final Verdict: Our Recommendation

Based on comprehensive analysis of security reports, user experiences, and platform characteristics, we strongly advise against investing in Marsses.com.

Why We Don’t Recommend Marsses:

Unrealistic returns (175-321% APR)

Classified as “financial scam” by security platforms

Hidden ownership and lack of transparency

HYIP characteristics (Ponzi scheme indicators)

Withdrawal issues reported by users

Suspicious review patterns

High-risk registrar with history of scam sites

The Bottom Line:

While Marsses presents a professional-looking website with impressive promises, the evidence overwhelmingly suggests this is a high-risk investment that exhibits classic scam characteristics. The astronomical returns promised are mathematically unsustainable through legitimate staking mechanisms.

If something sounds too good to be true in cryptocurrency, it almost always is.

For genuine passive income from cryptocurrency, stick with established, regulated platforms that offer realistic returns backed by transparent blockchain validation processes.

Stay safe, invest wisely, and always do your due diligence before trusting any platform with your money.

Have you had experience with Marsses? Share your story in the comments to help others make informed decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry inherent risks. Always conduct your own research and consult with financial professionals before making investment decisions.