Binance remains the undisputed champion of the global cryptocurrency exchange market by volume, serving millions of users worldwide with an unparalleled range of services. The platform is not just a place to buy and sell crypto; it is a sprawling ecosystem covering spot trading, advanced derivatives, staking, lending, NFTs, and its own blockchain, the BNB Chain.

Our in-depth Binance review for 2025 explores every facet of the exchange, from its ultra-low Binance fees to its current regulatory standing and security protocols, helping you determine if it is the right choice for your crypto journey.

Quick Verdict at a Glance (Pros & Cons)

| Pros | Cons |

| Lowest Fees in the industry (especially with BNB discount). | Significant regulatory challenges historically & ongoing compliance burden. |

| Unmatched Liquidity and trade volume for all major assets. | Complex interface and product suite can overwhelm beginners. |

| Widest Asset Variety (400+ coins) and trading pairs globally. | Customer support can be slow, primarily relying on ticket system. |

| Comprehensive ecosystem: Spot, Futures, Staking, Earn, NFT, P2P. | Restricted functionality or separate entity (e.g., Binance.US) for some regions. |

| Strong, independently verifiable Binance security measures (SAFU, PoR). | Recent leadership changes (CZ stepping down) may cause uncertainty. |

Verdict: Binance is the best choice for experienced crypto traders, high-volume users, and those seeking the widest array of crypto products, primarily due to its unbeatable fees and deep liquidity. Beginners may face a steep learning curve but will benefit from the platform’s core advantages once they navigate the initial complexity.

What is Binance? (Background, History, Footprint)

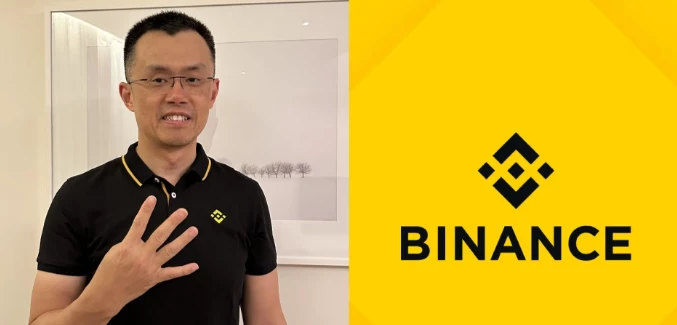

Founded in 2017 by Changpeng Zhao (CZ), Binance quickly rose to prominence and has maintained its status as the world’s largest cryptocurrency exchange by trading volume. Initially based in China, it rapidly shifted operations globally to become a decentralized entity, holding licenses and registrations in dozens of jurisdictions today.

Binance’s success stems from its low-fee structure, high-speed matching engine, and rapid expansion of its product offerings. The platform’s native token, BNB, which powers the BNB Smart Chain (BSC), is a top-tier cryptocurrency by market capitalization and offers users further discounts on Binance fees. Despite its past regulatory hurdles, Binance currently serves tens of millions of users globally and handles billions in daily trading volume, solidifying its dominant position in the industry.

Key Features of Binance

Binance’s strength lies in its comprehensive product suite, which caters to everything from simple crypto purchases to highly advanced trading and yield generation.

Spot Trading & Market Access

The core of Binance is its spot trading platform, which offers hundreds of cryptocurrencies and thousands of trading pairs. The platform’s liquidity is unmatched, allowing for large trades with minimal price slippage. Users can choose between a beginner-friendly “Convert” option for instant swaps or the “Classic/Advanced” interface for full access to charting tools (powered by TradingView), multiple order types, and real-time market data. The sheer variety ensures that you can find nearly any major or mid-cap altcoin on the exchange.

Derivatives, Futures & Margin

For the advanced trader, Binance offers one of the deepest derivatives markets globally. This includes:

- Futures Trading: USDT-M (linear) and COIN-M (inverse) futures with high leverage options.

- Margin Trading: Allows users to borrow funds to amplify potential returns (and losses) on spot trades.

- Options and Leveraged Tokens: Complex instruments for advanced speculation and hedging.

Note: Futures trading is high-risk and is often restricted in certain jurisdictions.

Staking, “Earn”, Lending & Savings

Binance offers a robust passive income suite under the banner of Binance Earn.

- Simple Earn: Flexible and fixed-term staking/savings for popular assets like BTC, ETH, and stablecoins, often with competitive Annual Percentage Yields (APYs).

- ETH Staking: Dedicated service for staking Ethereum and receiving BETH rewards.

- Launchpad & Launchpool: Access to new token launches by staking BNB or other assets, offering an early entry point into new projects.

NFTs, P2P, Wallet & App Ecosystem

Binance’s ecosystem extends beyond trading:

- Binance NFT Marketplace: A rapidly growing marketplace for digital collectibles and art.

- P2P Trading: A peer-to-peer marketplace that allows users to how to use Binance to trade directly with other users using local fiat currencies.

- Binance Mobile App: The Binance app is essential, providing full trading capabilities, account management, and access to the Earn features on the go. The “Lite” mode caters specifically to simple transactions and beginners.

- Trust Wallet: The exchange’s official decentralized wallet for storing and managing crypto off-exchange.

Fees & Pricing Breakdown

Binance is widely considered the low-cost leader in the crypto exchange space, which is a major draw for high-frequency traders. Understanding the fee structure is crucial to maximizing your trading capital.

Spot Fees Table

Binance employs a tiered Maker-Taker fee structure based on a user’s 30-day trading volume (in equivalent USD) or their minimum BNB holdings. The default, or ‘Regular User,’ fees are highly competitive.

| VIP Level | 30-Day Trading Volume (USD) | BNB Holding (Min) | Maker Fee | Taker Fee |

| Regular | < $1,000,000 | < 25 BNB | 0.1000% | 0.1000% |

| VIP 1 | ≥ $1,000,000 | ≥ 25 BNB | 0.0900% | 0.1000% |

| VIP 2 | ≥ $5,000,000 | ≥ 50 BNB | 0.0800% | 0.1000% |

| … | … | … | … | … |

Withdrawal & Deposit Fees

- Crypto Deposits: Generally free.

- Fiat Deposits: Vary by currency and method (e.g., bank transfer, credit card). Bank transfers are often free or very low cost.

- Crypto Withdrawal Fees: Variable. These are not a percentage but a fixed, small amount that covers the network transaction fee. This cost is asset-specific and blockchain-dependent (e.g., BTC withdrawal fee differs from ETH).

Discount Mechanisms (e.g., BNB usage)

The most popular way to reduce Binance fees is by paying them using your BNB balance.

- BNB Discount: Users who elect to pay their trading fees with BNB automatically receive a 25% discount on spot trading fees. This can drop your base fee from 0.10% to 0.075%, making it one of the cheapest ways to trade.

Security & Safety Measures

Security is paramount in any Binance review. While the exchange has faced public scrutiny, its technological security measures are industry-leading. This addresses the critical question: Is Binance Safe & Legit?

Cold Storage & SAFU Fund

The vast majority of customer funds are held in secure, geographically distributed cold storage (wallets not connected to the internet). Additionally, Binance established the SAFU (Secure Asset Fund for Users), an emergency insurance fund designed to protect users in extreme cases of a security breach or unexpected loss. This fund is valued in billions of dollars and is stored in separate cold wallets.

Regulatory History & Legal Issues

Binance’s regulatory journey is complex. The exchange has operated with a global mindset, often leading to clashes with national regulators. In late 2023, Binance and its founder, CZ, resolved a significant investigation with U.S. authorities related to historical money laundering and sanctions violations, resulting in a substantial fine and the implementation of a rigorous compliance monitoring program.

Despite these past issues, Binance has dramatically increased its compliance spending and team, securing operational licenses and registrations in numerous countries in 2024 and 2025. This pivot signals a strong commitment to regulatory adherence moving forward, though legal proceedings (like the ongoing SEC case regarding the classification of certain tokens as securities) continue to be monitored.

Proof-of-Reserves, Audit/Transparency

Following industry events in 2022, Binance introduced a Proof-of-Reserves (PoR) system, which allows users to verify that the exchange holds 100%+ of customer assets. Binance regularly releases updated Merkle Tree PoR reports, showing a commitment to transparency and confirming that customer funds for major assets like BTC, ETH, and USDT are fully backed. As of its latest report, Binance consistently maintains over 100% collateralization for all major crypto assets.

User Experience – Platform & App Review

The Binance platform is a double-edged sword: it offers immense power but at the cost of simplicity.

Desktop Platform: The primary trading interface (Advanced) is a professional, high-grade trading suite. It is heavily feature-rich, suitable for technical analysis and complex order strategies. For a beginner trying to figure out how to use Binance, the dense data and multiple menus can be daunting.

Mobile App: The Binance app successfully bridges this gap. Users can toggle between:

- Binance Lite: A streamlined, clean interface perfect for checking balances, simple buying/selling, and portfolio monitoring.

- Binance Pro: The full-featured, professional trading interface accessible on mobile.

The overall UX is excellent for experienced traders but requires patience for those just starting out.

Asset Variety & Liquidity

Binance’s liquidity is its defining competitive advantage. As the largest exchange by volume, it offers the tightest spreads and the best execution for trades, even large block trades. With support for over 400 cryptocurrencies and thousands of trading pairs, it has the widest selection on the market. This high liquidity makes Binance the go-to platform for trading everything from Bitcoin (BTC) and Ethereum (ETH) to niche altcoins.

Customer Support, Reputation & Regional Restrictions

Customer support is an area where Binance, like many giant exchanges, struggles. While it offers 24/7 support across numerous languages, the primary channel is a bot-driven live chat leading to a ticket system. Resolution times can vary significantly, which frustrates users when dealing with complex account issues.

Reputation: Despite its regulatory controversies, Binance maintains a strong reputation for its technology, security, and low fees. The recent focus on compliance and the appointment of a new CEO, Richard Teng, are viewed as positive steps toward long-term stability and regulatory acceptance.

Regional Restrictions: Binance’s global platform is not available in all countries, most notably the United States. US residents must use the separate, regulated entity, Binance.US, which offers fewer features and a more limited selection of assets. Users should confirm local regulations and platform availability before signing up.

Binance vs Competitors (e.g., Coinbase, Kraken)

| Feature | Binance (Global) | Coinbase (US & Global) | Kraken (Global) |

| Spot Fees | 0.10% (0.075% w/ BNB) | ~0.60% (Simple Buy) to 0.40% (Advanced Trade) | 0.26% (Instant Buy) to 0.16%/0.26% (Kraken Pro) |

| Asset Variety | 400+ | ~250+ | ~230+ |

| Liquidity | Highest | High | High |

| Advanced Products | Futures, Options, Margin, Earn, Launchpad (Extensive) | Limited Futures (select regions), Staking | Futures (select regions), Staking |

| Best For | Volume Traders, Altcoin Access, Low Fees | Beginners, Institutional Investors, Security/Regulation Focus | Experienced Traders, Security, Fiat Gateway |

Binance’s clear advantage is its low-cost structure and product depth, while competitors like Coinbase are often preferred for their ease of use, strong regulatory compliance, and simple fiat on/off-ramps in specific markets. When evaluating Binance vs Coinbase, the decision usually boils down to low fees and features (Binance) versus regulatory assurance and simplicity (Coinbase).

Who Should Use Binance? (Beginners vs Experienced)

Who Should Use Binance:

- Experienced Traders: Those who engage in high-frequency trading, use margin or futures, and demand deep liquidity.

- Volume Traders: Users who benefit from the tiered fee structure and BNB discount.

- Altcoin Enthusiasts: Those who want access to a wide variety of smaller and mid-cap tokens.

Who Should Avoid Binance (or use the Lite version):

- Absolute Beginners: The platform’s complexity can be overwhelming; a simpler exchange might be a better starting point.

- Users in Highly Restricted Regions (e.g., the US): They must use Binance.US, which offers a diminished service compared to the global platform.

How to Get Started – Step by Step

- Register an Account: Visit the official Binance website or download the Binance app and sign up using your email or mobile number.

- Complete KYC (Know Your Customer): Upload the required identification documents (ID, proof of address). This is mandatory for full platform access and to comply with anti-money laundering regulations.

- Enable 2FA: Set up Two-Factor Authentication (2FA) using Google Authenticator or a hardware key for maximum Binance security.

- Deposit Funds: Deposit fiat currency (via bank transfer, card, or P2P) or transfer existing cryptocurrency from an external wallet.

- Start Trading: Navigate to the “Convert” tab for simple trades or the “Advanced” trading interface to how to trade on Binance with full charting tools.

Final Verdict & Rating Summary

Binance Review 2025 Rating: 4.5/5.0

Binance earns its high rating by delivering a best-in-class product for serious crypto traders. The combination of industry-low Binance fees, unparalleled market liquidity, and the comprehensive feature set—from advanced futures to flexible staking—makes it the essential exchange for any experienced participant. While its regulatory challenges and complexity are drawbacks, the platform’s proactive security measures (SAFU, PoR) and recent compliance push confirm its place as the global leader. It remains the powerhouse for those looking for maximum features and minimal cost.

FAQ (Frequently Asked Questions)

Is Binance safe to use in 2025?

Yes. Binance is generally considered safe. It employs industry-leading security measures, including the SAFU insurance fund and robust Proof-of-Reserves (PoR) system, allowing users to verify that their funds are fully backed. While it has a complex regulatory history, the exchange has significantly increased its compliance efforts globally.

How does Binance make money with such low fees?

Binance utilizes its massive scale. By handling the world’s largest trading volume, even the small Binance fees (0.10% base fee) generate substantial revenue. Additionally, the platform makes money from futures trading, lending, launchpad participation, and its BNB Smart Chain ecosystem fees.

What is the Binance BNB coin used for?

BNB (Binance Coin) has two main uses: 1) It powers the BNB Smart Chain (BSC) network, used to pay transaction fees (gas). 2) On the Binance exchange, holding BNB provides discounts on trading fees (a 25% discount on spot trading fees) and grants access to exclusive token sales on the Binance Launchpad.

Are my crypto deposits with Binance insured?

Binance has an emergency insurance fund called SAFU (Secure Asset Fund for Users). This fund is intended to cover user losses in the event of a catastrophic security breach, though it is not the same as government-backed FDIC or similar insurance for banks.

What is the primary difference between Binance and Binance.US?

Binance is the global exchange with the full suite of products and the widest selection of assets. Binance.US is a separate, regulated entity designed specifically for residents of the United States. It offers a much smaller selection of cryptocurrencies, fewer features (e.g., restricted futures trading), and a different fee structure to comply with US financial regulations.

2 thoughts on “Binance Review 2025 – Is Binance Safe & Worth Using?”

Comments are closed.