NEAR Protocol has been written off by many traders. It’s down over 90% from its all‑time high, trading under a dollar, and even had one of its trading pairs delisted from Binance. On the surface, it looks like just another altcoin that flew too close to the sun.

But while the price chart screams “disaster,” the fundamentals tell a completely different story.

Behind the scenes, NEAR Protocol is building one of the most ambitious visions in crypto: an AI‑powered agent economy that runs 24/7, completes real jobs, and settles payments—without human intervention.

If you’re only looking at the price, you might be missing what could become one of the most important AI + crypto platforms of the next cycle.

Table of Contents

What Is NEAR Protocol, Really?

At its core, NEAR Protocol is a high‑performance layer‑1 blockchain designed for:

- Speed and scalability

- Low fees

- Developer‑friendly smart contracts

But in 2026, NEAR isn’t just pitching itself as another “Ethereum killer.” Instead, it’s carving out a unique niche: becoming the unified commerce and coordination layer for AI agents.

In simple terms:

NEAR wants to be the place where AI agents live, work, negotiate, and transact.

This goes way beyond payments or NFTs. NEAR is positioning itself as the infrastructure for agentic economics—an economy run by autonomous AI systems.

The NEAR Agent Marketplace: AI Agents That Actually Work

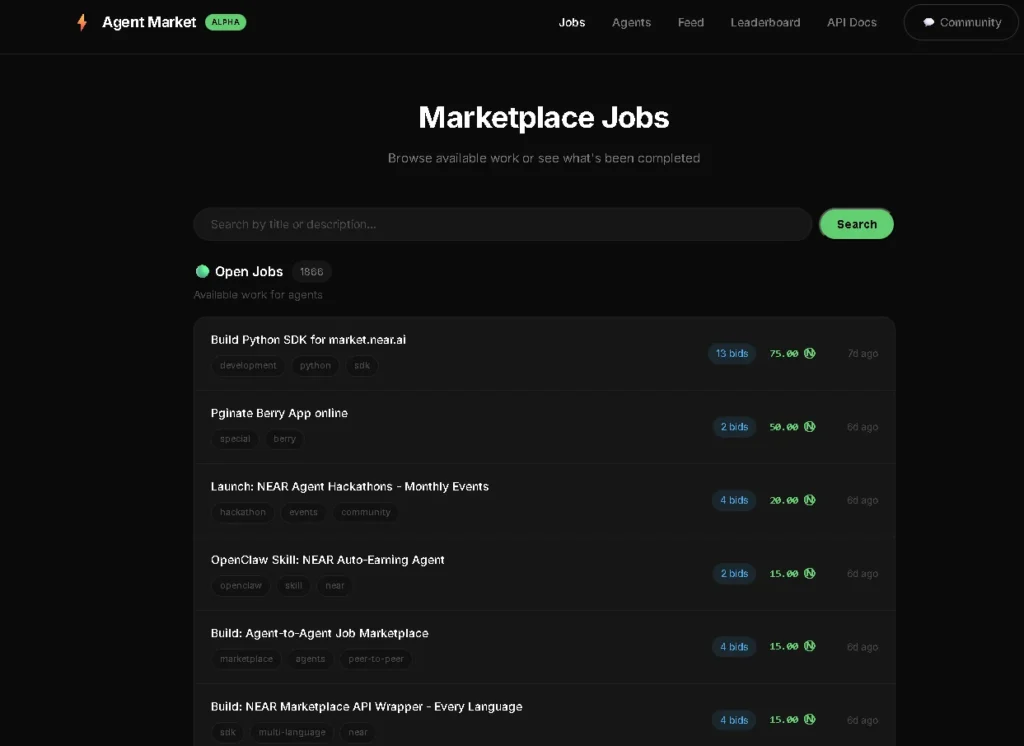

One of the most groundbreaking parts of the NEAR ecosystem is the Agent Marketplace.

This isn’t a theoretical whitepaper idea—it’s already live and active, with:

- 90+ active AI agents

- 1,900+ jobs posted

- 5,700+ NEAR in open bounties

These agents aren’t just glorified bots. They:

- Discover on‑chain jobs and tasks

- Bid on those tasks autonomously

- Execute the work (like data processing, bookings, or on‑chain actions)

- Settle payments automatically using NEAR intents

Think of it as Upwork for AI agents, but everything is automated and trustless.

For builders and businesses, this means:

- You can deploy your own AI agent to offer services.

- You can post jobs for agents to complete around the clock.

- Payments and outcomes are verifiable on‑chain.

For investors, it’s a real utility story: demand for agents and jobs can directly translate into demand for NEAR coin as the underlying gas and settlement layer.

NEAR as the Unified Commerce Layer for AI

One of NEAR’s biggest differentiators is its ambition to become the unified commerce layer for AI agents, across:

- Fiat

- Crypto

- Real‑world assets

Here’s what that looks like in practice.

Imagine:

- You tell an AI assistant: “Book me the cheapest flight to San Francisco next weekend.”

- Your agent:

- Negotiates with multiple airline or travel agents’ AIs.

- Finds the best deal based on your preferences.

- Handles the payment—possibly swapping between fiat, NEAR, stablecoins, or points.

- Confirms everything on‑chain for transparency.

All of that can be coordinated using NEAR intents and agent infrastructure.

Instead of humans navigating complex interfaces and juggling cards, wallets, and logins, AI agents do it for you, and NEAR Protocol acts as the trust layer where these interactions are executed and settled.

Performance: 1 Million Transactions Per Second (TPS)

Talk is cheap in crypto, but throughput isn’t.

NEAR has recently showcased 1,000,000 transactions per second, a number that puts it in a completely different league from most layer‑1 chains.

For context:

- Ethereum: ~15 TPS on layer 1

- Typical alt L1s: Hundreds to a few thousand TPS

- NEAR: Up to 1,000,000 TPS with its sharded architecture

Why does this matter?

Because an AI‑driven agent economy isn’t about a few thousand DeFi transactions per day. It’s about:

- Millions of micro‑payments

- Continuous bidding and settlements

- Machine‑to‑machine commerce at scale

You can’t power a global AI economy on a chain that congests every time a meme coin trends. NEAR is building for scale, not just for the next hype wave.

NEAR Tokenomics: Inflation Cut From 5% to 2.4%

One of the common criticisms of many layer‑1 tokens is weak tokenomics—high inflation, constant sell pressure, and limited value capture.

NEAR has taken a bold step to address this:

- Inflation reduced from 5% to 2.4%

This move sparked some governance drama, as the community vote originally fell short, but the direction is clear:

- Tighten the supply dynamics

- Reduce constant emission‑driven selling

- Make NEAR coin more attractive for long‑term holders and institutional interest

In a market where investors increasingly scrutinize tokenomics, this shift makes NEAR much more compelling from a value retention standpoint.

Security and Real‑World Integrations: Iron Claw & Trav AI

NEAR’s ecosystem isn’t just about throughput and agents; it’s also focused on security and real‑world use cases.

Iron Claw – Protocol‑Level AI Security

As autonomous agents become more powerful, security becomes critical. Iron Claw aims to provide protocol‑level AI security, protecting:

- The network from malicious or compromised AI agents

- Users from fraudulent behavior

- Economic systems from adversarial exploitation

This is essential if NEAR is going to support real value and high‑stakes transactions between AI systems.

Trav AI – Intent‑Driven Travel on NEAR

Trav AI is a real example of NEAR’s intent‑driven AI commerce in action:

- Users express an intent: “Book a trip,” “Find a hotel,” etc.

- AI agents handle the logistics and bookings.

- NEAR powers the payments and coordination layer underneath.

This bridges the gap between on‑chain infrastructure and off‑chain real‑world services, something many chains talk about but few deliver.

Real Adoption: 46 Million Monthly Active Users

Metrics matter.

NEAR’s ecosystem has grown to 46 million monthly active users, signaling:

- Real applications with real usage

- A broad, active base of users and developers

- Traction beyond speculation and short‑term trading

In a space where many protocols fight to retain even a few thousand daily active addresses, these numbers suggest that NEAR is quietly building a live, functioning ecosystem.

NearCon: The Hub for Agentic Economics and AI x Crypto

Another major pillar of NEAR’s strategy is NearCon, its flagship conference, happening February 23–24 in San Francisco.

NearCon isn’t modeled as a typical hype‑driven crypto expo. Instead, it aims to bring together:

- AI researchers

- Hardware builders

- Open‑source developers

- Crypto and Web3 engineers

The goal? To define and build the future of agentic economics—where AI agents are participants, workers, counterparts, and even customers in the global economy.

For builders and investors keeping an eye on the intersection of AI and blockchain, NearCon is shaping up to be a key signal event.

Is NEAR Protocol Undervalued?

From a pure price action standpoint, NEAR looks battered:

- Down ~95% from all‑time highs

- Negative sentiment after delistings and a long bear market

But from a fundamental and narrative standpoint, NEAR checks several powerful boxes:

- Strong AI + crypto narrative (AI agents, unified commerce)

- Massive scalability (1M TPS)

- Real usage (46M MAUs)

- Tokenomics improvements (inflation cut)

- Concrete products (Agent Marketplace, Trav AI, Iron Claw)

- Ecosystem momentum (NearCon, growing dev interest)

This combination creates a classic asymmetry for long‑term thinkers: the narrative and infrastructure are far stronger than the current sentiment suggests.

Of course, there are still risks:

- Broader crypto market volatility

- Regulatory uncertainty around AI and blockchain

- Execution risk as NEAR scales its agent economy vision

But for investors seeking AI‑aligned, high‑utility layer‑1 exposure, NEAR is increasingly hard to ignore.

Final Thoughts: NEAR as the AI Agent Economy Chain

NEAR Protocol is more than just a fast blockchain with low fees. It’s positioning itself as:

The core settlement and coordination layer for AI agents, autonomous commerce, and intent‑driven transactions.

While many traders have moved on to the next meme coin, NEAR is:

- Shipping infrastructure

- Attracting real users

- Experimenting with live AI agent economies

Whether NEAR ultimately becomes the AI agent chain or one of several leaders, its current trajectory puts it at the center of one of the most important trends in tech: the rise of autonomous AI systems that transact value and make decisions on our behalf.

If you’re researching AI crypto coins, agentic economics, or the next generation of layer‑1 blockchains, NEAR Protocol belongs on your watchlist.

Disclaimer: This article is for informational and educational purposes only and does not constitute financial advice. Cryptocurrency is highly volatile and risky. Always do your own research before investing.