In the world of cryptocurrency, hope is a powerful drug. For years, XRP holders have been waiting for the “any day now” moment—the tipping point where institutional adoption sends the token to the moon. But as the market evolves, it is becoming increasingly vital to separate the marketing narratives from the actual technical mechanisms.

If you are betting on XRP, you have to ask yourself: what exactly are you betting on?

Table of Contents

The Uncomfortable Truth About $3 XRP

While a $3 price point would trigger victory laps for many, we have to look back at the cycles that brought us here. Many investors are trained by the crypto industry to hold onto hope while ignoring glaring risks. Eight months ago, the signals suggested it was time to sell, yet many stayed.

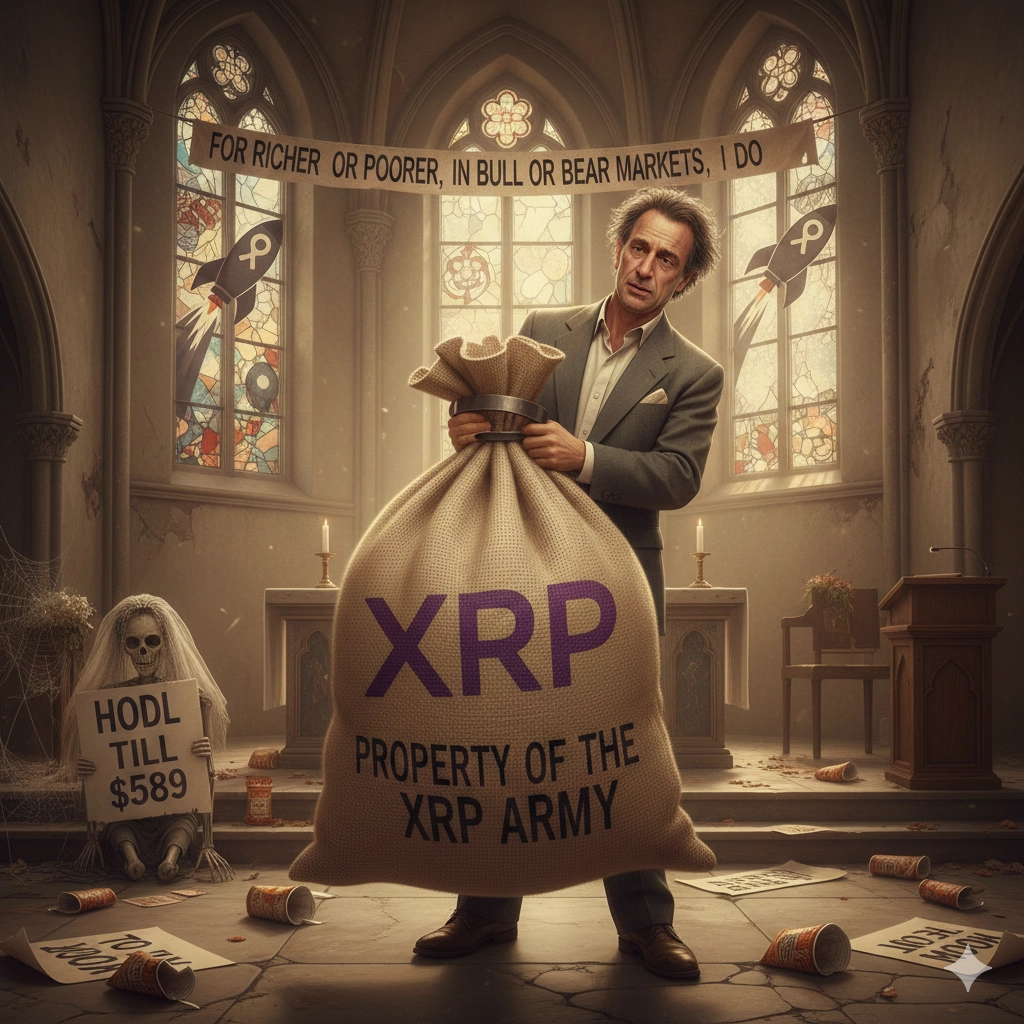

This “marrying the bag” mentality often stems from a fundamental misunderstanding of how Ripple’s technology actually works. Instead of focusing solely on price action, it’s crucial to examine the underlying use cases and adoption rates that drive sustainable value.

Ripple’s technology was designed for efficient cross-border payments, but real-world integration has been gradual and faces stiff competition from both legacy systems and emerging blockchain solutions. Blind faith in exponential gains distracts from the need to assess tangible progress—such as new partnerships, regulatory developments, or network transaction volumes. Investors should remember that markets are cyclical by nature.

Chasing highs or clinging to assets out of loyalty often leads to missed opportunities elsewhere. A disciplined approach means recognizing when fundamentals diverge from hype and being willing to adapt strategies accordingly. Ultimately, understanding what actually powers Ripple’s ecosystem—and remaining objective about its prospects—will yield better results than simply hoping for a return to peak prices without critical analysis.

Mechanism vs. Marketing: The RippleNet Disconnect

The biggest misconception in the community is that RippleNet adoption automatically equals XRP demand. This is simply not true. RippleNet is a sophisticated network for compliance messaging and value transfer, but institutions can—and do—use it without ever touching XRP.

Banks have the option to move value in fiat currency using RippleNet’s rails. According to various product overviews and explainers, XRP primarily comes into play only when using On-Demand Liquidity (ODL). If a bank can settle a cross-border transaction using fiat-to-fiat rails on the same network, the incentive to hold and use a volatile digital asset like XRP diminishes for many traditional institutions.

Utility vs. Speculation

This creates a significant risk for long-term holders. If the technological rails can run while skipping the token, then the price of that token isn’t driven by “unavoidable utility.” Instead, it remains at the mercy of narratives, liquidity cycles, and pure speculation.

The question remains: if a bank can send currency to another country via fiat on RippleNet, why would they take on the extra step and risk of buying XRP?

Managing Your Strategy

The goal isn’t to tell you whether to buy or sell, but to urge you to stop confusing a company’s network growth with your coin’s price appreciation. They are not the same thing.

If your portfolio is up, it is time to manage your risk and take profits. If you are down, stop letting emotional attachment dictate your financial future. The “four-figure XRP” predictions often come from a place of hype rather than technical reality. In a market driven by data, logic must eventually outweigh the narrative.

Conclusion: Logic Over Lore

Ultimately, the future of XRP depends on whether its utility becomes a necessity rather than an option. While Ripple as a company continues to make impressive strides in global financial infrastructure, investors must remain objective about how much of that success actually trickles down to the token.

The crypto market is unforgiving to those who prioritize “diamond hands” over disciplined risk management. By distinguishing between institutional networking and token demand, you can move away from the noise of moonshot predictions and toward a more grounded, professional investment strategy. Don’t wait for a miracle narrative to save your portfolio—watch the mechanisms, respect the data, and always have an exit plan.